XRP Price Prediction: Is Ripple on the Verge of a Major Breakout?

Explore the latest XRP price prediction, whale accumulation trends, and Ripple vs. SEC lawsuit updates. Is XRP primed for a breakout to $12? Get expert insights now.

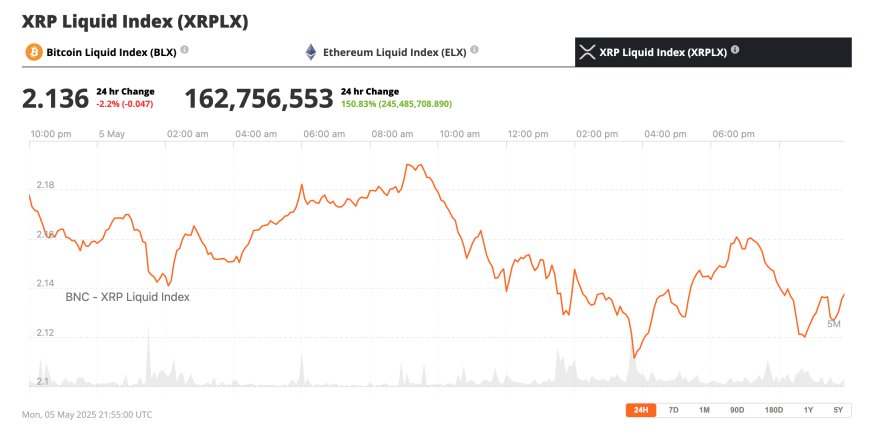

XRP is hovering at a pivotal level, trading just above the crucial psychological barrier of $2. With growing investor interest and market analysts on high alert, the crypto community is watching closely for signs of a potential bullish breakout.

Ripple's Price Outlook Influenced by Technicals, Whales, and Legal News

As of Tuesday, May 6, XRP is trading at $2.18, fluctuating within a narrow range between $2.13 and $2.17. While recent price action has been subdued and derivative sentiment remains cautious, technical analysis and broader market forecasts suggest that XRP could be gearing up for a significant upward move.

🐋 Whales Are Loading Up on $XRP

On-chain data from Santiment reveals that whales have been on a buying spree over the past month:

🔹 Addresses holding 1M-10M XRP scooped up 190M tokens

🔹 Larger whales (10M–100M XRP) accumulated a massive 440M

Whales often buy low in… pic.twitter.com/1SgEagjhxH — Trader Edge (@Pro_Trader_Edge) May 5, 2025

Elliott Wave Theory Points to $12 XRP by 2026

Well-known crypto analyst EWCycles has presented a compelling bullish case for XRP. According to his Elliott Wave analysis, the token is poised to enter a third wave rally—a historically strong phase in the wave cycle. If this pattern unfolds, XRP could surge to as high as $12 between 2025 and 2026, marking a staggering 2,900% gain from recent lows.

EWCycles highlighted the importance of XRP establishing higher highs and lows within a rising price channel. “If XRP maintains its footing above $2, the technical foundation favors a long-term uptrend,” the analyst stated.

$XRP really looking forward for this upward continuation! Soon the extensive move will form to make this one a double-digits crypto. Target is the same since before it broke out => around $12.#Elliottwave #XRP pic.twitter.com/z0LzNl5irL — EWT (@EWcycles) May 4, 2025

Adding to the bullish case, XRP has also formed a falling wedge on the four-hour chart—a classic bullish reversal pattern. A decisive break above $2.36 could trigger a short-term rally of around 7%, with the next price target near $2.59. Conversely, a drop below $2.13 could see prices retreat toward $1.96.

Whales Quietly Accumulate XRP, Fueling Bullish Sentiment

On-chain data shows large holders are accumulating XRP at an impressive pace. In the past month, wallets holding between 10 million and 100 million XRP have scooped up a total of 440 million tokens an indicator of growing confidence from institutional investors.

According to Santiment, whale activity often picks up during quiet periods. “Accumulation during low volatility phases often precedes strong upward moves,” an analyst noted.

However, there's a slight pause in high-value transactions, with a dip in XRP transfers above $100,000 and $1 million. Combined with $4.89 million in liquidated long positions in the derivatives market over 24 hours, this suggests some short-term uncertainty among traders.

Technical Indicators Align with Bullish Momentum

Despite resistance near $2.50, marking the 50% Fibonacci retracement from the $3.40 peak, several technical indicators support a positive short-term outlook. The Relative Strength Index (RSI) remains above 54, and the MACD histogram is flashing green, both pointing to strengthening momentum.

Source: MetaShackle on TradingView

One particularly bullish pattern, the Reverse Dragon, is forming, hinting that XRP could break out toward the $3 level shortly. Traders are eyeing key resistance points at $2.35, $2.45, and $2.50, where a daily close above could ignite fresh buying interest.

Legal Developments: A Potential Game-Changer for XRP

Ripple's ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) remains a critical variable in XRP’s price trajectory. The SEC has extended its appeal deadline to June 15, 2025, just two days before a decision is expected on Franklin Templeton’s proposed XRP ETF. The timing has sparked speculation about behind-the-scenes coordination.

Legal expert Bill Morgan called this sequence “potentially strategic,” suggesting it could mark the beginning of the end of the prolonged lawsuit.

A favorable resolution, either through an appeal dismissal or ETF approval, could remove significant regulatory uncertainty, unlocking new growth potential. Dan Tapiero of 10T Holdings noted that such developments could “unleash real upside for XRP” by restoring investor confidence.

Market insiders predict that XRP could triple in value if clarity from the SEC emerges, making legal outcomes a powerful catalyst.

Short-Term Challenges Remain Despite Long-Term Optimism

While the long-term outlook remains positive, XRP faces mixed signals in the near term. The token has struggled to hold above $2.25, and bearish divergence on the daily chart has capped upward momentum. A drop below the $2.15 support level could see XRP revisit the $2.00 or even $1.95 mark.

Recent data shows a 24% uptick in XRP derivatives volume, but open interest has stayed mostly flat. This signals hesitation among traders awaiting a clearer narrative from both technical and legal perspectives.

Source: XRP Liquid Index (XRPLX)

Outlook: XRP’s Future Hinges on Crucial Weeks Ahead

XRP finds itself at a crossroads, caught between strong technical support and mounting resistance. Over the coming weeks, all eyes will be on developments in the Ripple vs. SEC case, potential ETF approval, and whether the token can break out above key resistance levels.

Should Ripple achieve a favorable legal outcome and technical momentum builds, XRP could be set for one of its most explosive rallies in years. Until then, the $2 support zone remains the battleground one that could dictate the next chapter in XRP’s journey.