Will the SEC Approve an XRP Spot ETF in 2025? Here’s What We Know

Over the past few weeks, excitement and speculation have surged across the XRP community, with many wondering if the U.S. Securities and Exchange Commission (SEC) will green-light a spot exchange-traded fund (ETF) for XRP this year.

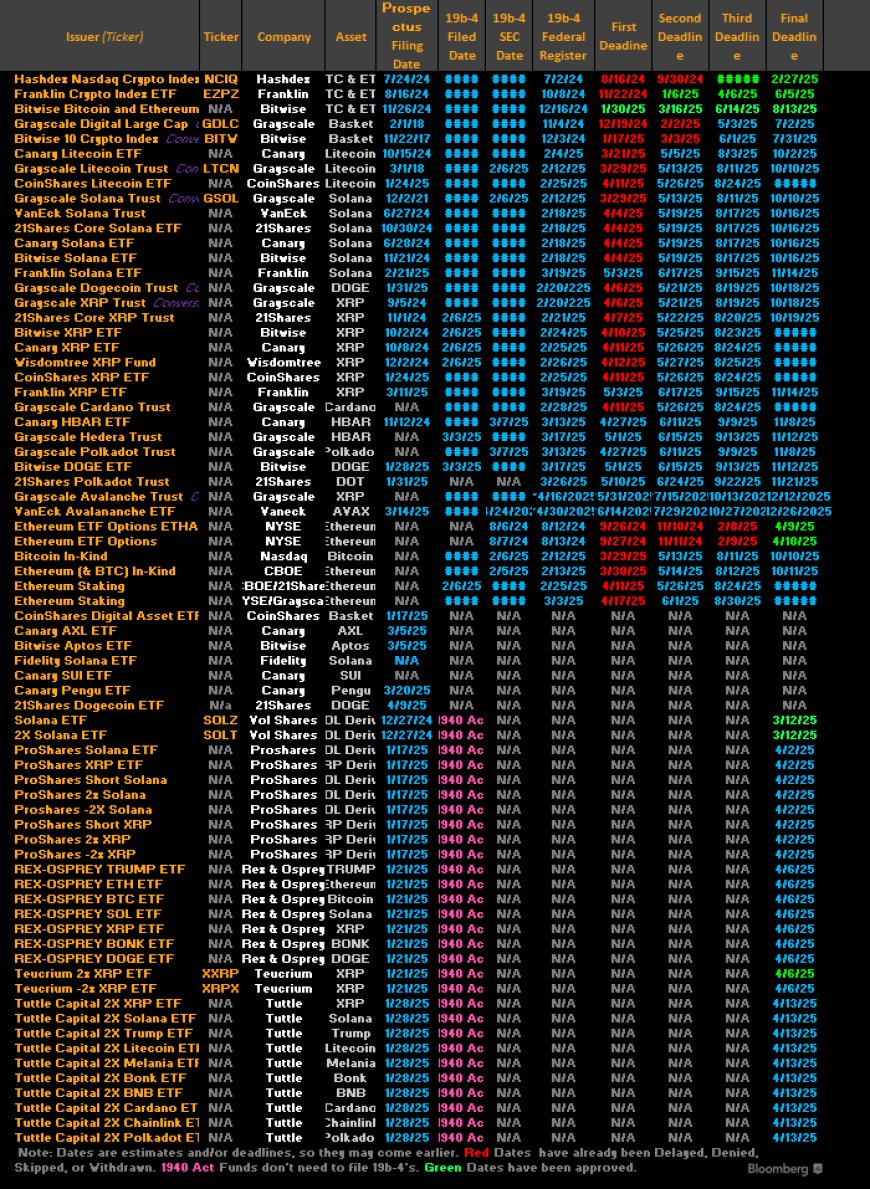

This growing buzz follows a notable uptick in interest from major asset managers. More than 10 prominent firms have already submitted S-1 filings to the SEC in hopes of launching XRP ETFs in the U.S. market.

Major Players Join the Race for XRP ETFs

Industry giants like Grayscale, 21Shares, Bitwise, Canary, WisdomTree, CoinShares, and Franklin Templeton are leading the charge. On the exchange side, Cboe and NYSE Arca have each filed 19b-4 forms, aiming to list and trade shares of these XRP-based ETFs on their platforms.

SEC Decision Timeline: What’s Next?

As institutional demand grows, XRP influencer “GA Spark” recently shed light on the SEC’s timeline for making a final decision. Once the SEC acknowledges an ETF filing, it has a maximum of 240 days to approve or reject the proposal.

While the agency was initially expected to make a decision on several filings—including those from VanEck, REX-Osprey, Tuttle Capital, and ProShares—by April 13, the SEC opted to delay. Now, XRP enthusiasts are watching closely for final verdicts on the remaining applications.

Key Dates to Watch for XRP ETF Approvals

GA Spark has shared a detailed breakdown of deadlines for upcoming decisions:

- Grayscale: October 18, 2025

- 21Shares: October 19, 2025

- Bitwise: October 20, 2025

- Canary: October 24, 2025

- WisdomTree, CoinShares, and Franklin: October 25, 2025

Though each fund has a specific deadline, the SEC has the flexibility to issue a decision at any time within the 240-day window. This mirrors the agency’s past moves, such as its simultaneous approval of several spot Bitcoin and Ethereum ETFs in 2024.

Optimism Grows Among XRP Investors

Despite regulatory delays, sentiment across the XRP community remains largely positive. According to Polymarket, bettors currently place a 79% chance on XRP ETFs receiving SEC approval by the end of 2025. However, odds for an earlier decision by July 31 have dipped slightly to 43%, reflecting daily market fluctuations.

This optimism stems from a noticeable shift in the SEC's stance toward crypto regulation. Under the current administration, the agency has shown greater openness to the digital asset sector compared to previous years, fueling hopes that an XRP ETF may finally become a reality.

XRP ETFs Among 72 Pending Crypto Fund Applications

XRP isn't alone in this regulatory waiting game. It’s one of 72 crypto spot ETFs currently under SEC review, according to Bloomberg ETF analyst Eric Balchunas. Other proposed ETFs include those tracking Solana, Cardano, Dogecoin, Litecoin, and even the Official Melania meme coin.

As XRP’s institutional appeal continues to grow, all eyes are on the SEC in anticipation of its next move. Whether or not XRP secures ETF approval in 2025, one thing is clear—crypto is stepping further into the mainstream, and XRP is firmly at the forefront of that movement.