Sui Blockchain: A Game-Changer in the Layer 1 Landscape or Just Another Flash in the Pan?

Discover how Sui blockchain is revolutionizing Layer 1 scalability with lightning-fast transactions, Move smart contracts, and zero downtime. Is it the future of Web3?

Sui (pronounced "swee") is emerging as one of the most talked-about Layer 1 blockchains thanks to its focus on performance, scalability, and user-friendly development features. Built from the ground up by Mysten Labs, a team of former Meta engineers, Sui promises to process high transaction volumes efficiently, without the congestion that plagues many legacy blockchains.

A Next-Gen Blockchain Engineered by Meta Veterans

Launched in May 2023, Sui is far from a random startup experiment. The team behind it includes CTO Sam Blackshear, creator of the Move programming language; CEO Evan Cheng, a veteran of both Meta and Apple; and CPO Adeniyi Abiodun, who helped develop Meta’s Novi wallet. Their collective experience gives Sui a strong technical and institutional foundation, but it also raises expectations—it’s not enough to look good on paper; Sui has to deliver in real-world conditions.

Backed by Big Players and Big Money

Investors seem to believe in Sui’s potential. The project has raised a staggering $336 million from heavyweights like Andreessen Horowitz (a16z), FTX Ventures, Binance Labs, Coinbase Ventures, and Jump Crypto. These funding levels rival those seen in Ethereum and Solana’s early days, signaling serious confidence in Sui's infrastructure to power next-generation financial services, DeFi protocols, and Web3 games.

Rapid Growth, Zero Downtime

Since its official launch, Sui has soared past $1 billion in Total Value Locked (TVL) by early 2024, an impressive feat for such a young network. Even more notable is that it has avoided any major network outages, unlike some of its competitors. But the bigger question looms: Can Sui move beyond hype-driven adoption and sustain long-term growth?

What Makes Sui Unique: A Closer Look at Its Architecture

At the heart of Sui is its parallel execution engine, which is designed to sidestep the bottlenecks of traditional sequential transaction processing. Rather than using an account-based system like Ethereum, Sui takes an object-centric approach, allowing multiple independent transactions to be finalized simultaneously. This boosts speed and efficiency, especially important for applications that require fast finality like gaming and high-frequency trading.

Powered by Delegated Proof-of-Stake and DAG

Sui employs a Delegated Proof-of-Stake (DPoS) model and incorporates a Directed Acyclic Graph (DAG) structure to streamline transaction validation and data flow. Validators are chosen based on the amount of $SUI tokens staked, ensuring a mix of decentralization and high throughput.

While this structure enhances scalability, it does pose a common DPoS risk: centralization if too much stake is concentrated among a few validators. To combat this, Sui encourages broad delegator participation, allowing token holders to support validators and earn rewards without operating a full node.

Move Programming Language: Safer Smart Contracts by Design

A major differentiator for Sui is its use of the Move language, originally developed for Meta’s Diem project. Move’s resource-oriented programming helps eliminate common smart contract vulnerabilities like double-spending or asset duplication—issues that plague platforms relying on Solidity.

This makes Sui especially appealing for developers building financial apps, NFTs, and complex game economies where asset integrity and security are non-negotiable. However, adoption of Move still lags behind Solidity, and convincing developers to migrate will be a long-term challenge.

Narwhal & Bullshark: Sui’s Dual Consensus System

Sui uses a two-part consensus mechanism known as Narwhal and Bullshark. Narwhal handles transaction ordering (acting like a mempool), while Bullshark ensures finalization via Byzantine Fault Tolerance (BFT).

Under ideal conditions, this architecture can theoretically handle up to 125,000 transactions per second (TPS). But it’s worth noting that ideal conditions rarely mirror real-world scenarios. Sui’s performance in live environments over time will ultimately determine whether these figures hold up.

Tackling Blockchain Storage and Costs

One of Sui’s forward-thinking features is its Storage Fund, which introduces an upfront payment model. Users cover the cost of storing their transactions, helping reduce long-term burdens on validators. While innovative, the sustainability of this model at scale still needs to be proven as transaction volumes rise.

Understanding $SUI Tokenomics

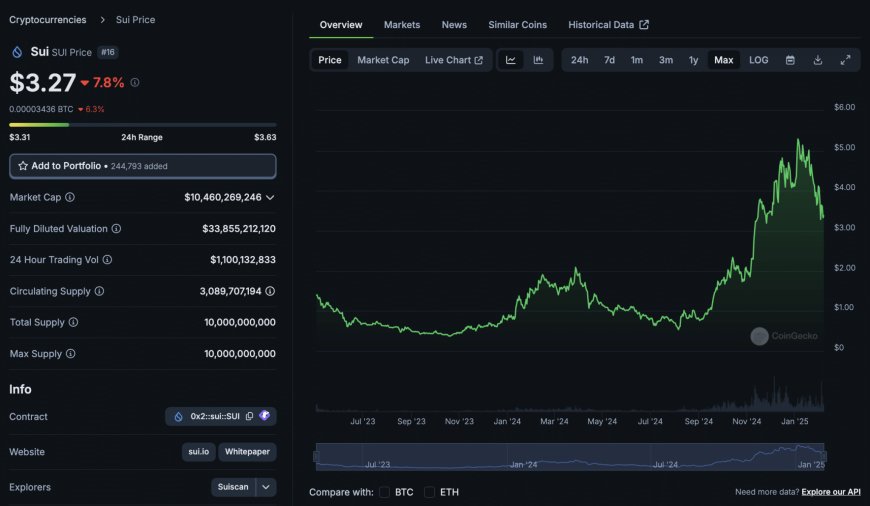

The native token of the Sui network, $SUI, plays a vital role in ecosystem operations. With a fixed total supply of 10 billion tokens, its distribution is designed to encourage long-term stability while avoiding runaway inflation.

As of early 2025, approximately 3.1 billion tokens are in circulation, with the rest scheduled for gradual release through 2030. This helps prevent sudden price crashes, but upcoming unlocks could introduce volatility if ecosystem demand doesn’t scale at the same pace.

Key Use Cases of $SUI:

- Transaction Fees: Used for all on-chain actions

- Staking & Security: Stakeholders support network security and earn rewards

- Governance: Holders vote on upgrades, validator rules, and economic policies

- Ecosystem Development: 50% of the supply is earmarked for grants and community initiatives

Unlike Ethereum, Sui does not burn gas fees, opting instead for a dynamic pricing model that adjusts every 24 hours based on network demand. While this aims to stabilize fees, it’s unclear how effective it will be during traffic surges.

The Battle for Developers: Can Sui Stand Out?

Sui isn’t alone in using the Move programming language Aptos, another blockchain founded by ex-Meta engineers, is also courting the same developer base. That makes talent acquisition a competitive game.

To truly compete with Ethereum’s developer dominance and Solana’s performance reputation, Sui will need to show that its platform is not just fast but also developer-friendly and scalable in production environments.

Sui’s DPoS Model: Balancing Speed and Decentralization

Sui’s Delegated Proof-of-Stake system emphasizes low-latency finality without compromising on security. Unlike older blockchains, where validators process blocks one after another, Sui allows validators to execute independent transactions in parallel, greatly reducing latency when network conditions are optimal.

Still, decentralization remains a concern. While delegator participation helps spread influence, the risk of validator dominance persists. Long-term success will hinge on how Sui manages this balance as its ecosystem matures.

Final Verdict: Is Sui a Layer 1 Powerhouse in the Making?

Sui is an ambitious, technically sophisticated Layer 1 blockchain that offers a fresh take on scalability, security, and developer experience. Its object-centric model, Move-based smart contracts, and parallel execution could very well redefine what’s possible in blockchain infrastructure.

The early numbers are promising over $2.1 billion in TVL, zero network outages, and strong investor backing. But the long-term test will be whether Sui can attract and retain developers, launch high-impact dApps, and sustain token value through real-world adoption.

The Road Ahead

- As Sui heads deeper into 2025, the key questions remain:

- Will developers embrace the Move ecosystem over Solidity?

- Can Sui maintain decentralization while scaling throughput?

- How will token unlocks impact long-term price stability?

- Can it compete with Solana and Aptos for user and project adoption?

Only time will tell if Sui becomes a foundational pillar of Web3 or just another ambitious experiment in the blockchain archives.