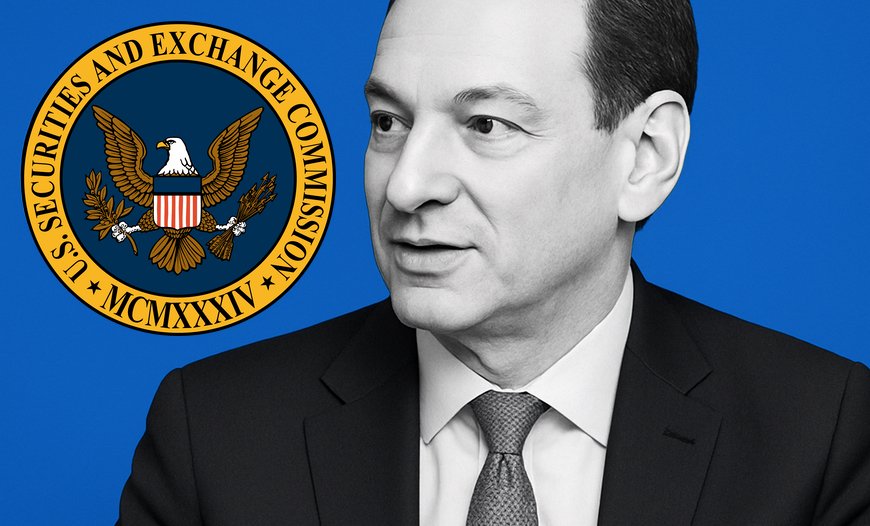

Paul Atkins Sworn In as 34th SEC Chairman, Signals New Crypto-Friendly Era

Paul Atkins has officially taken the helm as the 34th Chairman of the U.S. Securities and Exchange Commission (SEC), marking a significant leadership shift for the agency. The announcement was made on April 21, just days after the U.S. Senate confirmed his appointment in a 52-44 vote on April 9.

“I’m deeply honored by the trust President Trump and the Senate have placed in me,” said Atkins. “It’s a privilege to return to the SEC and work alongside the dedicated professionals and fellow commissioners committed to our mission supporting capital formation, protecting investors, and maintaining fair and efficient markets.”

Atkins previously served as an SEC commissioner from 2002 to 2008, and his return is widely seen as a turning point for crypto regulation in the United States. Industry insiders expect his leadership to be considerably more open to digital assets compared to his predecessor, Gary Gensler, who served under the Biden administration.

Crypto Ties Spark Delays, but Reveal Industry Alignment

Atkins' confirmation wasn’t without hurdles. Reports suggest that the delay stemmed from financial disclosures related to his recent marriage into a billionaire family. These filings reportedly revealed up to $6 million in crypto-related investments, including stakes in Anchorage Digital, a crypto custody platform, and Securitize, a blockchain tokenization company.

A Shift in Crypto Policy at the SEC

Atkins succeeds acting chair Mark Uyeda, who had initiated the creation of a Crypto Task Force earlier this year. This task force aims to foster stronger collaboration between the SEC and the blockchain industry.

Since Atkins’ confirmation, several crypto enforcement actions spearheaded by Gensler’s administration have been quietly rolled back. Notably, high-profile investigations involving Coinbase, Consensys, Gemini, and Uniswap have been dropped or paused, hinting at a broader shift in regulatory philosophy.

2025: A Defining Year for Crypto ETFs

The new SEC under Atkins is already facing a mountain of crypto-related decisions. According to Bloomberg, the agency is reviewing over 70 exchange-traded fund (ETF) applications linked to digital assets as of April 21.

“Everything from XRP, Litecoin and Solana to Penguins, Doge and 2x Melania, it’s all on the table,” said Bloomberg ETF analyst James Balchunas in a recent post on X.

His colleague, James Seyffart, added that issuers are employing a “spaghetti cannon approach,” throwing a wide array of products at the new SEC in hopes of seeing what sticks.

“We’re going to see a flood of new crypto ETF concepts in the coming months,” Seyffart predicted. “Firms want to be first to market, and they’re betting on this SEC being more receptive.”

As Paul Atkins begins his term as SEC Chairman, the crypto community is watching closely. With regulatory pressure easing and a flood of new investment products on the horizon, 2025 could become a landmark year for crypto adoption and innovation in the United States.

Whether you're an investor, a developer, or a digital asset enthusiast, one thing is clear: the future of crypto regulation in the U.S. just got a lot more interesting.