How Distributed Validator Technology (DVT) Is Revolutionizing Ethereum Staking for Institutions

Discover how Obol’s Distributed Validator Technology (DVT) is transforming Ethereum staking with enhanced security, decentralization, and scalability—trusted by top institutions and protocols.

Ethereum staking is undergoing a major transformation. As more institutional players enter the space, the need for infrastructure that’s secure, decentralized, and scalable has never been greater. However, traditional staking setups often fall short, posing risks to performance, resilience, and decentralization.

Enter Distributed Validator Technology (DVT) a game-changing innovation helping Ethereum overcome these challenges. Spearheaded by Obol, a leading decentralized validator network, DVT is quickly becoming the go-to solution for institutional staking.

The Institutional Staking Bottleneck

Despite rapid institutional interest, Ethereum staking has faced three core limitations:

- Centralization risks, with a small number of operators dominating the ecosystem.

- Security vulnerabilities, especially from single points of failure.

- Scalability constraints are limiting Ethereum’s ability to support broader adoption.

These bottlenecks have prevented Ethereum staking from reaching its full potential until now.

What Is Distributed Validator Technology?

At its core, Distributed Validator Technology breaks down the responsibilities of a single validator and distributes them across multiple, independent operators located around the world.

Rather than relying on one node with one private key, Obol’s DVT model uses multi-party computation (MPC) to split key responsibilities across a group. Each operator only holds a fragment of the private key, eliminating central points of failure and significantly reducing the risk of slashing or downtime.

Key features of Obol’s DVT include:

- No on-chain private keys drastically improve security.

- Built-in reward splitting ensures transparent and fair payouts without third-party intermediaries.

- Seamless integration works with existing Ethereum clients and middleware.

- Performance parity or better, DVT validators have matched or exceeded traditional validator benchmarks.

Scaling Ethereum with Obol

Obol isn’t just another staking tool; it’s a movement to decentralize the foundation of Web3. More than 800 distributed validators already help secure over $1 billion in ETH on the mainnet.

Obol’s impact stretches beyond the technical layer. As a founding member of both the Proof of Stake Alliance (POSA) and the Node Operator Risk Standard (NORS), Obol is actively shaping the future of institutional staking from both a policy and standards perspective.

👀 @VitalikButerin just mentioned:

" With 32 ETH or less than 32 ETH...there are more and more interesting pool options that are appearing...like Obol's Squad Staking". 👏

📺 Watch Vitalik on @EFDevcon Mainstage now! https://t.co/jheM5Zf8QU pic.twitter.com/2fmfWv5Vjg — Obol Collective (@Obol_Collective) November 12, 2024

Even Ethereum co-founder Vitalik Buterin has acknowledged the role Obol plays in pushing Ethereum closer to its decentralization goals.

The OBOL Token: Fueling Ecosystem Coordination

Obol recently launched the OBOL token to power governance and ecosystem coordination. Designed to support retroactive public goods funding and act as collateral in DeFi ecosystems, OBOL also enables decentralized decision-making for the Obol Collective.

This governance token ensures that Obol evolves in alignment with Ethereum’s core principles of decentralization, transparency, and community-driven innovation.

Real-World Adoption: Institutions Leading the Way

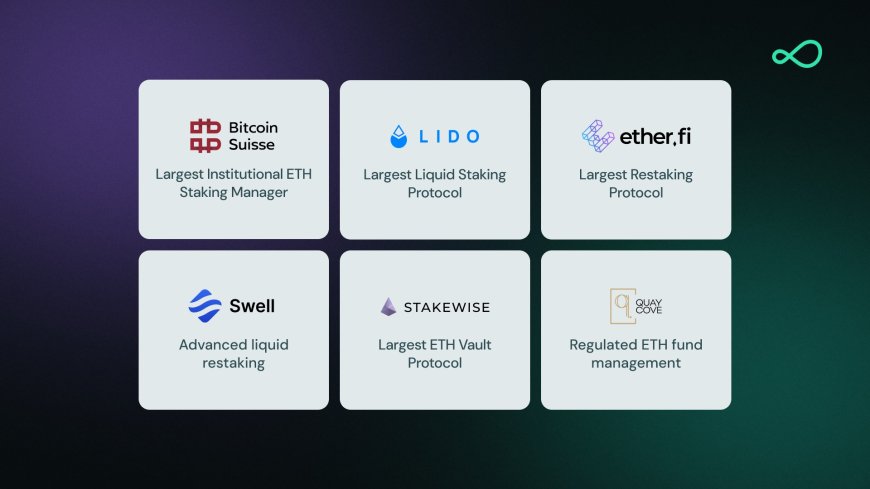

Major players in the Ethereum ecosystem are already turning to Obol for staking infrastructure. Here’s how it’s making a difference:

Bitcoin Suisse: Switzerland’s top crypto financial services firm turned to Obol after extensive due diligence. The result? Greater uptime, enhanced security, and seamless compliance make it a perfect fit for demanding institutional clients.

Lido: The largest liquid staking protocol, used to rely on a limited set of validators. With Obol’s Simple DVT integration, it scaled its validator set from 36 to over 200, onboarding solo stakers and smaller node operators for the first time, boosting decentralization and slashing resistance in the process.

EtherFi: Non-custodial staking protocol scaled from $100M to over $5B in TVL, Obol became essential to maintaining performance and resilience. Today, about 23% of EtherFi’s total stake runs on Obol DVT, outperforming even industry heavyweights like Lido and Coinbase Cloud.

Quay Cove: A regulated Ethereum fund based in New Zealand, uses Obol to deliver transparent, on-chain staking services to accredited investors. With insurance from Lloyd’s and operations managed by Everlasting, it offers institutional-grade protection and compliance.

StakeWise: With nearly half a billion dollars staked, chose Obol after evaluating multiple DVT solutions. Now transitioning its Genesis Vault to Obol, it’s improving uptime, returns, and fault tolerance for thousands of users.

Swell Network: Swell integrated Obol into its liquid restaking protocol, enabling a more decentralized validator architecture. The result: better performance, less slashing risk, and the ability to offer stronger incentives for users and validators alike.

What’s Next for Obol?

Following its token launch and widespread validator adoption, Obol is preparing to roll out the Obol Stack a full suite of infrastructure for the next generation of Ethereum applications. From validator management to dApp support, this evolution will position Obol at the center of Ethereum’s decentralized future.

Final Thoughts

As Ethereum grows and more institutions stake ETH, the need for secure, decentralized, and scalable validator infrastructure is urgent. Obol’s Distributed Validator Technology answers that call, offering a robust, real-world-proven solution already trusted by the biggest names in the space.

Whether you’re a protocol, a fund, or an institutional staker, Obol delivers a future-ready foundation for Ethereum staking. As the network continues its transition toward full decentralization, Obol stands as a gold standard, redefining how staking at scale should look.