Apple Faces Legal Setback and Tariff Fears: Stock Dips Amid Controversy Over App Store Practices

Apple faces legal backlash and tariff concerns, causing stock to dip. Judge accuses Apple of antitrust violations over App Store practices. Analysts lower price targets ahead of earnings report.

Apple Inc. is grappling with fresh legal and economic headwinds that have spooked investors and pushed its stock downward in after-hours trading. A U.S. District Judge has slammed the tech titan for failing to adhere to a court order stemming from its high-profile antitrust battle with Epic Games.

Judge Slams Apple for App Store Non-Compliance

On Wednesday evening, Judge Yvonne Gonzalez Rogers issued a stern rebuke to Apple, asserting that the company deliberately sidestepped a 2021 injunction that required it to open its App Store to alternative payment methods. While Apple emerged largely victorious in that legal showdown with Epic Games, the court mandated the company to permit third-party in-app payment systems a move aimed at fostering competition and reducing Apple’s control over App Store transactions.

However, Apple reportedly continued taking a hefty 27% commission on these external payments, just slightly below its standard 30%. The judge criticized the company for making it difficult for developers to promote or implement these alternative payment options, effectively undermining the court’s directive.

“Apple’s actions challenge belief,” Judge Rogers wrote in her ruling. “Despite full awareness of the injunction’s intent, the company continued its anticompetitive behavior purely to preserve its revenue.”

Potential Criminal Charges on the Horizon

Taking things a step further, Judge Rogers has referred the matter to the U.S. Attorney’s Office for the Northern District of California, raising the possibility of criminal contempt charges. This marks a serious escalation in Apple’s ongoing legal entanglements.

She didn’t hold back in her criticism: “In stark contrast to Apple’s sworn testimony, internal documents reveal the company knowingly chose the most anticompetitive routes at every turn.”

The court has now ordered Apple to immediately comply with the original injunction, making it clear that this is a binding legal directive, not a matter up for discussion.

In response, Apple issued a short statement: “We strongly disagree with the court’s decision,” a spokesperson told Barron’s. “However, we will comply with the order and plan to appeal.”

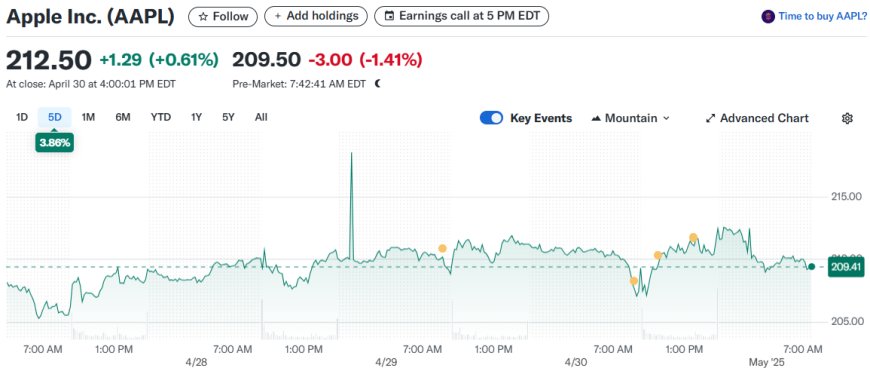

Following the ruling, Apple’s stock fell by 1.7% in after-hours trading on Wednesday as investor concerns mounted.

Tariff Risks Add More Pressure

Legal troubles aren’t the only cloud hanging over Apple. Wall Street analysts have become increasingly cautious, citing potential impacts from supply chain disruptions and looming tariff hikes.

Ahead of Apple’s upcoming March-quarter earnings report, at least three analysts have slashed their price targets:

Loop Capital’s Ananda Baruah maintained a "hold" rating but trimmed his price target from $230 to $215, citing weakening iPhone supply chain data.

Barclays analyst Tim Long was even more bearish, reducing his target to $173 from $197 and maintaining a "sell" rating. He warned that the back half of 2025 could be turbulent due to demand slowdowns and possible iPhone price increases triggered by new tariffs.

Raymond James analyst Srini Pajjuri held his "outperform" rating but lowered his target from $250 to $230. He cautioned that tariffs could reduce Apple’s earnings per share by as much as 10%.

“Our base case suggests Apple may raise U.S. prices to offset tariff costs, which could dampen consumer demand,” Pajjuri noted. However, he added that any short-term pullback might offer a long-term buying opportunity, given Apple’s loyal user base and thriving services division.

Earnings Preview: All Eyes on Apple’s Q2 Report

Apple is set to report its fiscal Q2 results after markets close on Thursday. Analysts anticipate earnings of $1.62 per share on revenue of $94.25 billion, reflecting 6% growth in profits and a 4% rise in sales compared to the previous year.

Looking ahead to the fiscal third quarter, Wall Street expects earnings to come in at $1.46 per share with $88.89 billion in revenue, marking a 5% and 4% year-over-year increase, respectively.

As Apple navigates increasing scrutiny from regulators and rising geopolitical risks, the spotlight will remain on how it adapts both legally and financially. One thing is clear: the stakes are higher than ever.